|

|

#301

|

||||

|

||||

|

Re: The relentless rising cost of living in Singapore

Quote:

|

|

#302

|

|||

|

|||

|

Tonight talking point on saving electric bills. Is not new. Back into the 2000? The news advice us on switch on one lights for the hold family. Turn a bit on the tap in order to fill waters, costs saving!

Much more. Is that so much the VIPs wish to scare us. They had to do better then this. |

|

#303

|

|||

|

|||

|

Re: The relentless rising cost of living in Singapore

http://theindependent.sg/netizen-all...or-membership/

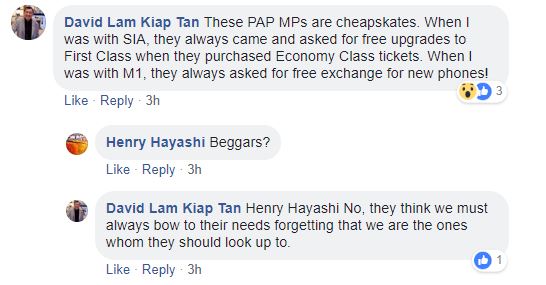

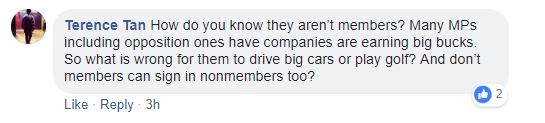

Netizen alleges that PAP MPs drive luxury cars and play golf at Yishun country club without paying for membership By Jewel Stolarchuk - July 19, 20184776  Facebook user Liew has alleged that he frequently sees a group of ruling party parliamentarians playing golf at the Orchid Country Club in Yishun, even though he believes these politicians are not members of the club. Liew further shared a video of several luxury cars, such as a McLaren and a Bentley that cost millions, parked at the club’s carpark and alleged that the vehicles are driven by People’s Action Party (PAP) MPs. Liew alleged that the white Bentley captured in the video belongs to a Bishan-Toa Payoh GRC MP and claimed: “Every Wednesday morning a bunch of PAP MP will play golf at Orchid country club. I am a paying member there and I am very sure they are not member. I am wondering is this perks make known to the public? Is it in line with what they so call clean wages. “I have taken a Video in the car park. They are all driving luxury car like Mclaren, Bentley that cost more than 1 m. Singapore now has no more civil servant, but only civil boss, that’s why they are driving bigger cars and living in bigger houses than us. We voted them to control us, sound very stupid hoh. The white Bentley SKK 418 R is own by Bishan MP” https://www.facebook.com/donald.liew...6528811779686/ Liew’s video has garnered over 12.000 views and more than 300 shares since he published it on his Facebook wall earlier today. Meanwhile, another netizen alleged that ruling party politicians frequently asked him for free upgrades to first class, when he was apparently working with Singapore Airlines. The netizen, Facebook user David Lam Kiap Tan, further claimed that when he began working with teleservices operator M1, PAP MPs would seek “free exchanges for new phones”:  While several netizens responding to Liew’s claims have responded by urging others to vote these MPs out at the next General Election, several others have expressed doubts at the veracity of Liew’s allegations and have opined that this may just be “fake news”. One such netizen, Facebook user Terence Tan, pointed out that even if the MPs are not members of the country club, they may have been signed in by their friends who are members:

|

|

#304

|

|||

|

|||

|

Re: The relentless rising cost of living in Singapore

Quote:

Grassroots leaders’ good intentions the root cause of financial lapses: Lim Swee Say Published on 2015-08-18 by Andrew Loh  Auditor General's Report Grassroots leaders involved in financial irregularities were only trying to help, said the deputy chairman of the People’s Association (PA), Lim Swee Say, in Parliament on Monday. “We can fault (grassroots volunteers) for their non-compliance of financial procedures, but please do not doubt them in their passion and commitment in always doing their best for the community,” Mr Lim said. He was responding to questions from Workers’ Party (WP) Member of Parliament (MP), Png Eng Huat, and Non-constituency MP, Lina Chiam, on the findings by the Auditor General in its report which was released in July. The AGO had found numerous incidents of non-compliance with financial rules among the ministries and statutory boards it audited. Among the most notable were those involving Nparks, which had awarded contracts valued at more than S$20 million without calling for open tenders; and the PA, where the AGO had conducted test-checks on about 115 grassroots organisations (GROs) under the PA umbrella.  OC, July 2015 Out of the GROs test-checked by the AGO, 30 per cent were found to have financial or accounting irregularities. Nonetheless, Mr Lim said, “I can say with confidence there is no irregularity at the system level.” Instead, he said the root cause of these lapses were the “good intentions” of the grassroots leaders. Mr Lim explained this by raising various examples of how grassroots leaders were “actually doing their best to serve the interests of the residents and meet the urgent needs of the community.” Mr Lim, who is also the Minister of Manpower, related how grassroots leaders had gone “all around Singapore” to look for face masks when the haze hit the island in 2013. This was after a community hospital had appealed to the GROs for air purifiers for patients who were being housed in the hospital’s non-airconditioned wards. When they found a “small store which had limited stock”, the grassroots leaders decided to purchase the masks without first calling for three tenders, which is what is required by the rules. “Madam Speaker, is this a case of non-compliance of financial procedures and rules? The answer is yes,” Mr Lim said. “Is this a case of grassroots leaders and volunteers compromising the interests of the community? The answer is certainly no.”  As for the chairman of the Admiralty Citizens’ Consultative Committee (CCC) who was found to have been involved in the award of a contract worth $32,000 to a company in which he was also a senior management executive, and also for writing and approving reimbursements cheques to himself worth $114,000, Mr Lim said, without identifying the chairman, Mr Tonic Oh: “Although there was no evidence of dishonesty, the CCC chairman has taken personal responsibility for these lapses and resigned from his position.” Mr Lim disclosed that the improprieties involving Mr Oh included money for a funeral wake which a needy family required immediately. “There was no supporting documents for the claim but the amount given was witnessed by a few volunteers,” the Straits Times reported Mr Lim as having told the House. Two other claims had receipts to justify the reimbursement, but out of another four claims by Mr Oh, only one had supporting documents. Also, 13 tenancy contracts amounting to $3.67 million were awarded by the GROs without competition. Despite their “good intentions”, Mr Lim said, this went against financial rules, which required them to obtain approvals, which the GROs involved did not. Turning to the AGO report itself, Mr Lim said the last time the PA received an “adverse opinion” rating from its auditors was in 2012. Previously, the PA’s own auditors had given it “adverse opinion” for at least 10 years prior to 2012, before the GROs’ accounts were included in the PA’s financial statements. Since consolidation of the accounts of all the 1,800 GROs under the PA in 2013, the PA’s financial statements have received “clean opinions” in FY 2013 and FY2014, Mr Lim said. He said, however, that the PA “cannot completely eradicate human error when it comes to financial governance.”  Mr Lim added that since the AGO report, the PA has set up a “Grassroots Finance Review Committee” to review its financial and procurement rules for grassroots organisations. Mr Lim noted that the committee – made up of three grassroots leaders from the PA – “consists of members with standing and expertise.” However, Mrs Chiam, who filed an Adjournment Motion on the AGO report, said an independent committee should be appointed to look into the matter instead. She said “the litany of financial lapses committed by the [PA]” has raised many issues, among them were:  First, that it has been more than a decade since PA’s Grassroots Organisations (“GROs”) have been audited. This was because the PA has not produced the financial statements of the GROs for audit, and has only done so in the financial year 2013/2014. She calls for these financial statements to be disclosed, and for them to be audited. Second, the pervasiveness of such poor financial practices across the 1,800 GROs since the AGO had only test-checked a mere 6.5% of the GROs. Third, that an independent review committee should be established instead of the Grassroots Finance Review Committee, chaired by three grassroots leaders, that was set up in the aftermath of the AGO report. The chairman of the PA, Lee Hsien Loong, did not speak on the issue in Parliament on Monday. |

|

#305

|

||||

|

||||

|

Re: The relentless rising cost of living in Singapore

Pap Mps driving Bentley , McLaren ?

If it's true , well i speechless ... Follow the links to the page , Scroll down and the video is at somewhere below 20+ posting . [https://m.facebook.com/donald.liew.7...&pn_ref=story] [Liew] is good,have a look at it!

__________________

The difference between a Phenomenon and a Champion is that the first is not scared of dying, while the second is. If it doesn't challenge you , it doesn't changes you . 人间最美丽漂亮动人动听感触的音乐 https://youtu.be/MqbJ9GzzEG4 |

|

#306

|

|||

|

|||

|

Re: The relentless rising cost of living in Singapore

Well, a very young footballer who is most likely to be less educated but knows how to donate his entire winnings from winning the world cup, what else can be said of our very wealthy and high earning smart politicians whom you don't see doing huge donations despite their wealth and income. Absurd claim to even suggest we need sky rocket salaries to prevent corruption. So where is the sense of serving the people and justifying your salaries by making big contributions to our nation? Sigh..

|

|

#307

|

||||

|

||||

|

Re: The relentless rising cost of living in Singapore

Quote:

__________________

Plse dont upz me Thank you |

|

#308

|

||||

|

||||

|

Re: The relentless rising cost of living in Singapore

Quote:

__________________

The difference between a Phenomenon and a Champion is that the first is not scared of dying, while the second is. If it doesn't challenge you , it doesn't changes you . 人间最美丽漂亮动人动听感触的音乐 https://youtu.be/MqbJ9GzzEG4 |

|

#309

|

|||

|

|||

|

Re: The relentless rising cost of living in Singapore

Quote:

|

|

#310

|

||||

|

||||

|

Re: The relentless rising cost of living in Singapore

Towards natives jo liao buay gao steady ..towards FT ,FW wa kua liao lao bak sai...

__________________

The difference between a Phenomenon and a Champion is that the first is not scared of dying, while the second is. If it doesn't challenge you , it doesn't changes you . 人间最美丽漂亮动人动听感触的音乐 https://youtu.be/MqbJ9GzzEG4 |

|

#311

|

|||

|

|||

|

Re: The relentless rising cost of living in Singapore

Quote:

Does not make sense right? |

|

#312

|

|||

|

|||

|

Re: The relentless rising cost of living in Singapore

Quote:

Vivian says M’sia benefitted from buying treated water at 21% of cost but why SG consumers charged at least 672%? Published on 2018-07-09 by Correspondent  In Parliament today (9 Jul), Foreign Minister Vivian Balakrishnan said he expects Malaysia to fully honour the terms of the 1962 Water Agreement, including the price of water, signed between Singapore and Malaysia. "The 1962 Water Agreement was guaranteed by both Singapore and Malaysia in the 1965 Separation Agreement, which in turn was registered with the United Nations," he said. Tying the 1962 Water Agreement to the 1965 Separation Agreement signed between both countries, Minister Balakrishnan added, "Any breach of the 1962 Water Agreement would call into question the Separation Agreement, which is the basis for Singapore's very existence as an independent sovereign state." Water has been in the spotlight in recent weeks after Dr Mahathir said in an interview with Bloomberg last month that the 1962 water supply deal with Singapore was "too costly" for Malaysia and that he wanted to talk to Singapore about it. "We will sit down and talk with them, like civilized people," Dr Mahathir told Bloomberg. The water agreement allows Singapore to draw up to 250 million gallons of raw water from Johor daily at three sen (1.01 Singapore cents) per 1,000 gallons. Vivian: Malaysia benefited from water pricing arrangement In Parliament, Minister Balakrishnan noted that Singapore has already stated its position on the water issue comprehensively. "The core issue is 'not how much we pay, but how any price revision is decided upon'," he said. "Neither Malaysia nor Singapore can unilaterally change the terms of this agreement between our two countries." He also added that Malaysia has previously acknowledged that they themselves have benefited from the pricing arrangement under the deal. Johor currently buys treated water from Singapore at 50 sen per 1,000 gallons, as provided for under the 1962 Water Agreement. This is a fraction of the cost to Singapore of treating the water, he further noted. "Hence, in 2002, then-PM Dr Mahathir said that Malaysia did not ask for a review when it was due as Malaysia knew that any revision would also affect the price of treated water sold by Singapore to Malaysia." According to a MFA media release on its website, it costs Singapore RM2.40 to treat every 1,000 gallons of water. By selling the treated water to Malaysia at 50 sen or 21% of cost, Singapore is providing a subsidy of RM1.90 per 1,000 gallons to Malaysia. Everyday, Singapore is providing a water subsidy of RM70,000 to Malaysia, it said.  Singaporean households charged at least 672% more for treated water from PUB Meanwhile, Singapore's water prices were raised earlier this month (1 Jul). The new water tariff which Singapore households now have to pay is: S$1.21 per cubic meter, for consumption below 40 cubic meter per month S$1.42 per cubic meter, for consumption exceeding 40 cubic meter per month This does not include the Water Conservation Tax or the Waterborne Fee. If both are included, the total water price would be: S$2.74 per cubic meter, for consumption below 40 cubic meter per month S$3.69 per cubic meter, for consumption exceeding 40 cubic meter per month  Since MFA said that it costs Singapore RM2.40 or S$0.81 to treat every 1,000 gallons (4.55 cubic meter) of water, that means it costs Singapore S$0.178 to treat every cubic meter of water. Including the cost of buying water from Malaysia at 3 sen per 1000 gallons or S$0.0022 per cubic meter, the total cost to Singapore for 1 cubic meter of treated water would be $0.178+$0.0022 or S$0.18. To summarize, PUB buys water from Malaysia at S$0.0022 per cubic meter and spends another S$0.178 per cubic meter to treat it, giving a total cost of S$0.18 per cubic meter. It then in turn, sells to Singaporean households at S$1.21 per cubic meter (using the above $1.21 rate and excluding Water Conservation Tax and the Waterborne Fee). This translate to at least 672% more Singaporean households have to pay for the treated water from PUB. And if we use the S$2.74 rate which is inclusive of taxes, Singaporean households end up paying 1,522% more. So, can PUB give Singaporeans a breakdown how consumers are being charged 672% more after buying water at 3 sen from Malaysia and treating it at RM2.40 per 1,000 gallons? Furthermore, can PUB also explain the S$1.1 billion profits it gained in the last 7 years, as noted by financial blogger Leong Sze Hian? Editor's note - It would help a lot to explain to the citizens on the cost to treat water via the Newater or desalination process. However, PUB chooses to lump everything together and justify the increase of water by simply referring to the investments made by the government on water treatment. Based on past figures, it seems that the government will eventually be profiting from the sale of utilities even though the upfront investment is high. |

|

#313

|

||||

|

||||

|

Re: The relentless rising cost of living in Singapore

Bottom line is the vote after 4 years.. last time was the best n closest time got chance to kick out white Monkeys.

Then 70% vote MIW. Really blind bats.. this type of ownself say ownself good govt, why vote for them ? Bcos Sporean greedy.. dangle a few carrots in front of them all attracted away liao... Hiaz ! |

|

#314

|

|||

|

|||

|

Re: The relentless rising cost of living in Singapore

Quote:

Temasek says it does not manage CPF savings, gets questioned By Andrew Loh - July 21, 20183079  In the past week, several postings by Temasek on its Facebook page has made claims which are being questioned by members of the public. But Temasek has also responded to the reactions by explaining its positions on these questions. As part of its “mostly commonly asked questions about us” series, the self-proclaimed “commercial investment company” had put up several posters providing answers to these queries. In them, Temasek claims that it “does not manage Singapore CPF savings, Singapore Government Reserves, [and] Singapore Foreign Reserves.” In another poster, it says that it in fact “is not a Sovereign Wealth Fund” but “a commercial investment company”, and “own and manage our own assets.” https://www.facebook.com/temasekhold...403848/?type=3  In a third, Temasek explains it operates “on commercial principles, pay taxes wherever we operate, and invests off of our own balance sheet.” Temasek is helmed by Ho Ching, the wife of Prime Minister Lee Hsien Loong. Its chairman is former minister Lim Boon Heng. Temasek’s postings immediately drew questions and criticisms from members of the public, who challenged its assertions. Shih-Tung Ngiam, commenting on the page on Temasek’s claim that it is not a sovereign wealth fund (SWF), but a “commercial investment company”, called it a “lie”. “This is an outright lie,” he said. “I do not understand why Temasek keeps trying to deny that it is an SWF. What benefit do Temasek insiders get from that denial ? Singapore does not gain anything. If anything we lose points on transparency and honesty.” But it is Temasek’s posting on the Central Provident Fund (CPF) savings that drew the most reactions from the public. The CPF is a compulsory savings plan for all working Singaporeans for retirement and housing needs, among others.  Some on Temasek’s page expressed disbelief that the fund does not manage CPF money, describing the claim as “a joke” and “fake news”, and asked Temasek where its funds for investment comes from, if not from CPF savings. Reactions also questioned the husband-and-wife relationship of the Chief Executive Officer (CEO) of Temasek and the Prime Minister. Temasek responded that CPF monies are invested by the CPF Board in Special Singapore Government Securities (SSGS) that are issued and guaranteed by the Singapore Government. “The proceeds from the SSGS are then invested by the government through MAS and GIC, just like how the proceeds from the market-based Singapore Government Securities (SGS) are invested,” Temasek says. “We also do not receive any SGSS proceeds for management,” it added. When asked to publish its financial statements, Temasek said: “Just to clarify, as a Singapore exempt private company under the Singapore Companies Act, we’re actually exempted from disclosing financial information publicly. Nonetheless, we’ve been publishing our Temasek Review annually since 2004 as a public marker of our performance. Also, you might be keen to know that our sole shareholder is the Minister for Finance; no other investors were involved in our growth over the last 44 years.” It then directed readers to this page for more information. The Ministry of Finance (MOF) explains on its webpage: “Temasek’s consolidated financial statements are audited by leading international audit firms. In addition, Temasek’s financial performance is scrutinised by bond rating agencies, which have given it a AAA credit rating.” Temasek also publishes its investments portfolio on its website. See here. Earlier this month, the fund reported a record net portfolio value of $308 billion. “It is now almost three times the dotcom peak of just over S$100 billion at the turn of the millennium,” Executive Director and CEO, Temasek International, Mr Lee Theng Kiat, said then. Chairman Lim said, “To succeed as an investor is not an end in itself. Ultimately, that success must be translated into a better and more sustainable world for our people and communities.” Temasek is one of three government entities which manage and contribute to the reserves. The other two are the Monetary Authority of Singapore (MAS) and the Government Investment Corporation Pte Ltd (GIC Pte Ltd). The actual size of the total reserves are not published but is estimated to be about $750 billion. Only MAS and Temasek disclose their assets. GIC Pte Ltd does not. The MOF explains “what has been revealed is that GIC manages well over US$100 billion.” “Revealing the exact size of assets that GIC manages will, taken together with the published assets of MAS and Temasek, amount to publishing the full size of Singapore’s financial reserves,” the MOF says. “It is not in our national interest to publish the full size of our reserves. If we do so, it will make it easier for markets to mount speculative attacks on the Singapore dollar during periods of vulnerability. For more detailed answers to the questions which readers posed to Temasek, perhaps it is best to refer to the Ministry of Finance website for the answers. Please click here. |

|

#315

|

||||

|

||||

|

Re: The relentless rising cost of living in Singapore

Quote:

__________________

Plse dont upz me Thank you |

| Advert Space Available |

|

| Bookmarks |

|

|

t Similar Threads

t Similar Threads

|

||||

| Thread | Thread Starter | Forum | Replies | Last Post |

| Serious JLB Indranee: Raise your salary to cope with rising cost of living! | Sammyboy RSS Feed | Coffee Shop Talk of a non sexual Nature | 0 | 22-02-2017 07:50 PM |

| Singapore 4th in Cost of Living but 26th in Quality of Living | Sammyboy RSS Feed | Coffee Shop Talk of a non sexual Nature | 0 | 21-07-2015 08:50 PM |

| The rising cost of living is squeezing working class singaporeans | Sammyboy RSS Feed | Coffee Shop Talk of a non sexual Nature | 0 | 25-03-2015 12:00 AM |

| The rising cost of living is squeezing working class singaporeans | Sammyboy RSS Feed | Coffee Shop Talk of a non sexual Nature | 0 | 24-03-2015 11:40 PM |

| The rising cost of living is squeezing working class singaporeans | Sammyboy RSS Feed | Coffee Shop Talk of a non sexual Nature | 0 | 24-03-2015 11:30 PM |